Healthcare Investing for the Post-COVID Era

Longfellow is a healthcare-focused lower middle market investment firm

We believe that the COVID pandemic has accelerated healthcare’s future and unleashed a wave of change

Within this new landscape, Longfellow invests in teams and companies positioned to win

Investment Criteria

We back founders and management teams operating within healthcare’s lower middle market. Our companies have proven business models and a track record of success. We don’t invest in start-ups, and we don’t invest in sclerotic, entrenched players.

Our goal is to help founders and managers take their businesses to the next level.

-

Transaction Type

Majority ownership, with very selective minority positions

-

Transaction Size

$25M-$75M equity per investment platform

-

Company Stage

Revenue-generating ($10M+) and a proven, profitable business

-

Company Growth Profile

Growing at 5x GDP or more (10-15%+ growth)

Healthcare Sectors of Interest

The COVID pandemic accelerated the future of healthcare and unleashed a wave of change. Some traditional businesses will struggle dealing with these changes.

Longfellow invests in healthcare companies that are poised to win in the new post-COVID environment.

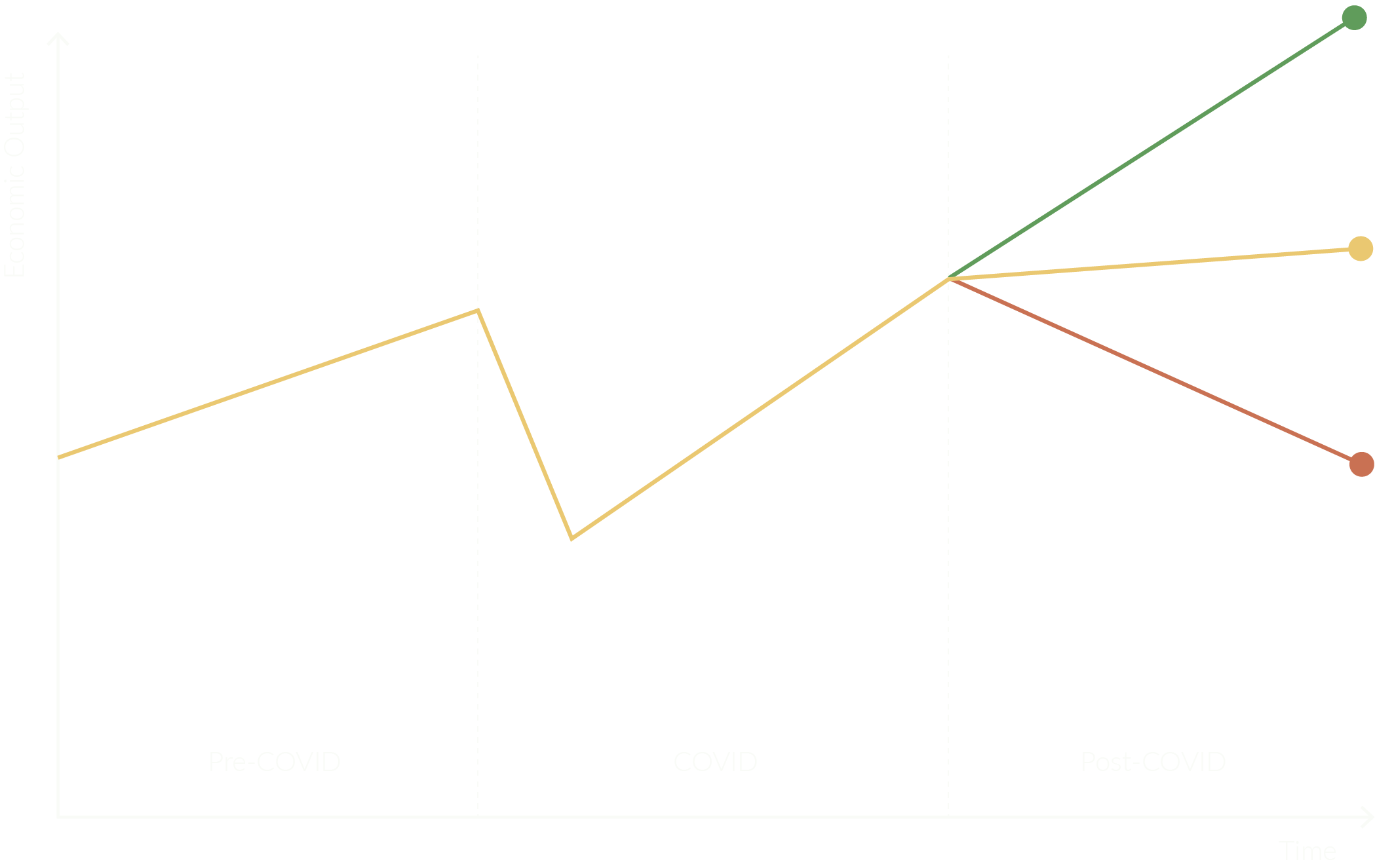

Longfellow invests in healthcare sub-sectors positioned to win

Next-gen managed care: Capitated and value-based care; home and community-based care; tech-enabled primary care; software and analytics that measure healthcare value and efficiency

Pharma and medtech services: Specialized capabilities that support next-gen therapies; remote clinical trials; software and advanced analytics; contract manufacturing with local footprints

Digital healthcare: Telehealth and virtual care that enable healthcare delivery at less intensive settings; e-pharmacy; at-home diagnostics and tools used by consumers to manage and monitor their health

Consumer-driven care: Patient-centered models for hard-to-treat diseases like in behavioral health; tools for consumers to manage and monitor their own health; quality and price transparency tools

Next-gen diagnostics: Specialized tools and diagnostics; application of AI for next-gen therapies; companion diagnostics; home-based monitoring

“Average” healthcare sub-sector will perform fine

Traditional pharma (with exceptions)

Basic medical equipment and consumables

Traditional critical / emergent care and traditional chronic care

Certain healthcare sub-sectors are likely to struggle

Facility-based, asset-intensive healthcare delivery models (e.g., hospitals, nursing homes, etc.)

Practice management groups that create limited efficiencies and misaligned incentives

Expensive / speculative technology with limited clinical value and subject to price pressure

Businesses dependent upon old, inefficient payment models like out-of-network billing

Long-Term Orientation

Unlike other private equity firms, we take a long-term approach to building companies.

We are not interested in the quick flip; we are not focused on raising the next fund. We want to build value over a long period of time.

Longfellow’s philosophy and structure have been informed by the wisdom of Warren Buffet and Charlie Munger. Our vision is to create a healthcare-focused mini-Berkshire Hathaway. Our circle of competence is healthcare, and our focus is creating long-term value.

Our name is inspired by the poet Henry Wadsworth Longfellow. His home of nearly 50 years is located steps from our offices in Cambridge, MA, and served as George Washington’s military headquarters from 1775-1776. The Longfellow House is an enduring symbol of longevity, constancy, and steadfastness.